Do HSA or FSA Cover Speech Therapy?

Here at Speech Buddies we frequently get questions about Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): is speech therapy FSA eligible, does HSA cover speech therapy? Some families currently have these accounts available to them and others are considering adding them, where available, to potentially reduce the cost of their family’s health care. Since speech therapy would generally be considered a covered expense (i.e. you would be able to use HSA or FSA to pay for speech therapy), these accounts could be a great way to defray overall costs. And with the enrollment period for 2016 fast approaching, a few minutes of planning may unlock significant savings for your family. This post is dedicated to shedding light on these options – as usual, there is some complexity here – so families needing to access speech therapy services can do so with a greater sense of empowerment.

What Are HSAs and FSAs?

Both of these accounts are meant to ease the cost of health care to your family. In both cases, you (and, in some cases, your employer) will contribute funds to the account, using pre-tax income. In other words, whatever dollar amount you choose to keep in the fund for that year comes out of earnings before they ever get taxed. This is how these plans save you money. There is a limit to how much you can contribute per year to these funds. Currently, for 2016, the maximum you and/or your employer may contribute to an HSA is $3,350 for individuals, and $6,750 for families; for an FSA that maximum is capped slightly lower at $2,550 for individuals and at $5,000 for families. Also keep in mind that there are small fees for maintaining an HSA or FSA. One bank that handles HSAs, Optum Bank, quoted a $3 per month fee for all balances below $5,000.

Both of these accounts are meant to ease the cost of health care to your family. In both cases, you (and, in some cases, your employer) will contribute funds to the account, using pre-tax income. In other words, whatever dollar amount you choose to keep in the fund for that year comes out of earnings before they ever get taxed. This is how these plans save you money. There is a limit to how much you can contribute per year to these funds. Currently, for 2016, the maximum you and/or your employer may contribute to an HSA is $3,350 for individuals, and $6,750 for families; for an FSA that maximum is capped slightly lower at $2,550 for individuals and at $5,000 for families. Also keep in mind that there are small fees for maintaining an HSA or FSA. One bank that handles HSAs, Optum Bank, quoted a $3 per month fee for all balances below $5,000.

How Are HSAs and FSAs the Same?

Another similarity between these plans is that they can only be set up by those who have something called high-deductible health plans. These plans typically are somewhat cheaper for you on a monthly premium basis, but when you see a doctor or have to go to the emergency room (i.e. in other words, you need to actually use the insurance), you have more to pay up front before the insurance will pay the rest. These deductibles apply for a calendar year typically and may apply for each insured person in your plan.

Each plan usually specifies the deductible for an individual and for a family. Either way, it’s worth having a representative from your insurance plan thoroughly explains what your deductible is, depending on your situation. So now you may wonder what qualifies as a high-deductible health plan that would enable you to establish an FSA or an HSA. Here are those numbers. In addition, both plans usually come with a debit card that you would simply swipe at a retailer or provider’s office to pay for goods or services.

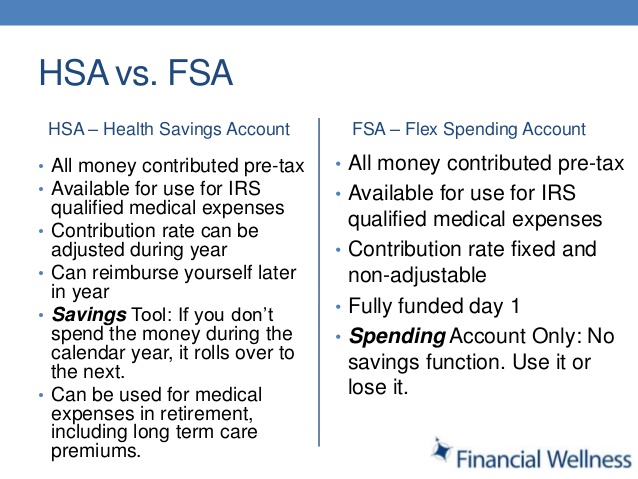

How are HSAs and FSAs Different?

The main difference is that the FSA is opened by an employer on behalf of an employee whereas the HSA is opened by the individual who will benefit from the account. How does this impact the accounts and how they’re used? Well, the FSA has a “use it or lose it” feature. This means that let’s say you contribute $500 for 2016 into an FSA. By March, 2017 (you have this small extra window of time) any unused funds in the FSA will become the property of your employer. So, this means that FSA holders should really think about their upcoming likely health-related expenses and not over-contribute, lest they risk losing their hard-earned cash. For your child in need of speech therapy, I’d recommend that you consult with your therapist to get a sense of how much therapy will likely be required. This can give you a great sense of how much to contribute to your FSA.

An HSA, on the other hand, belongs to you even though an employer may contribute to the account on your behalf as a benefit to you. You may therefore roll over remaining funds into the following year: the funds belong to you so you don’t lose them. You may also withdraw funds, though this is probably not a good idea as there could be penalties for doing so. The HSA then is simply an ongoing pool of money to use for any and all qualifying health care related expenses.

Another key difference between an HSA and an FSA is that the HSA allows you take money that you have that has already been taxed (i.e. your net income) and receive a tax deduction for this amount. An FSA, on the other hand, requires that this money be “new” money, in the form of income for example. Also, the HSA allows you to invest the money and allow it to grow while it is in the account, whereas an FSA doesn’t allow this option.

Slide from HSA Basics

So What to do?!

I would first like to strongly advise you to speak with a tax and/or financial advisor before making any substantive decisions regarding an HSA or FSA. This is meant as a guideline and information resource and not as tax and/or financial advice.

Probably the most important thing to get a handle on is the projected cost of the speech therapy services you seek. This is especially important if you are planning to fund an FSA to cover speech therapy. Don’t hesitate to ask your speech therapist how much therapy he or she expects your child to need. He or she won’t be able to say for sure but getting as close a sense of this amount as possible could save you hundreds of dollars.

Also, I would strongly recommend that you contact the administrator of your HSA or FSA to confirm that your child’s specific services are covered under the terms of your account. While the information that I’ve provided above can be a great general guideline, specific coverage indications are best pursued with the plan administrator itself.